27+ Debt payoff date calculator

27 years 3 months. A break-even period of 25 months is fine and 50 might be too but 75 months is too long.

Debt Payment Plan Printable If This Might Help You Use It Paying Off Credit Cards Credit Card Payoff Plan Debt Payoff Plan

Current tax rate is the lower of a 10 of profit or b 20 of profit adjusted after indexation benefits.

. Debt Reduction Planner Debt Evaluation Calculator Current Expense Calculator. 1724-2724 variable purchase APR based on creditworthiness. Credit Card Debit Payoff Calculator.

This move follows a 75 basis-point hike in. If you are making a lump sum extra payment enter the amount of the payment and the date of it in the calculator below. Credit Card Payoff Calculator Template Excel PDF Open Office that will calculate the payment which is required to pay off your all credit card debt in the specified number of the years.

Clients have access to a client dashboard to monitor their progress. Is accurate as of the publish date. However you cannot sell these units for 3 years from purchase date.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Theres a good chance you will refinance again or sell your home in the next 625 years. The way it works is that you throw everything you have at the first debt in line to be paid off.

30-Year Mortgages and Extra Payments. Free calculator to evaluate student loans by estimating the interest cost helping to understand the balance and evaluating pay-off options. Real estate construction loan property loan debt free loansmobile home loan hard money loan securedunsecured loaninvestment fundingExpansion loan Jv.

High interest debt will. Payoff does not issue loans in Massachusetts Mississippi Nebraska or. Unsecured debt such as credit cards are not tax deductible.

Our early mortgage payoff calculator will show you the standard monthly payment additional payment payoff date and total interest savings. If sold after 3 years from purchase date long term capital gain tax will be applicable. On July 27 the Federal Reserve announced another big rate hike raising the federal funds rate by 75 basis points bps to a range of 225 to 25.

The Grace Period is the period between the date of graduation and the date that repayment of a student loan must begin. Get 247 customer support help when you place a homework help service order with us. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

3 years 7 months. Company Company - Logo Minimum credit score Current APR range Loan amounts Learn More CTA text Learn more CTA below text LEARN MORE. And it will also tell you how much you have to pay to get rid of the debt.

It stands apart for its income-based repayment program. This calculator uses rollover payments to accelerate your payoff plan to get you debt free as soon as possible. Repeat the process until you are completely debt free.

Most homebuyers in America tend to obtain 30-year fixed-rate mortgagesAs of June 2020 the Urban Institute reports that 30-year fixed-rate loans account for 77 percent of new mortgages in the market. Early Mortgage Payoff Calculator. Rhode Island Student Loan Authority or RISLA is a Rhode Island-based nonprofit that refinances loans for customers across the country.

On its website DMCC offers educational resources for consumers. As you pay off each debt the freed-up amount is applied to the next debt. You will also get a mortgage payoff amortization schedule that shows you the details of each monthly payment such as interest and principal paid and remaining balance.

Borrowers need a credit score of 640 or higher to qualify for Payoff debt consolidation loans. The loan is secured on the borrowers property through a process. 2 years 9 months.

Posted on April 27 2017 July 9 2020 by exceltmp. And calculate how. Thats a debt obligation you agree to pay once a month which is usually for 30 or 15 years.

With this unique 4 column format you can compare scenarios side-by-side print amortization schedules and plan your payoff strategy. Early Payoff Amortization Schedule. Borrowers use that new loan usually at a lower interest rate to pay off all existing smaller debts.

Undebtit is a free mobile-friendly debt snowball calculator that generates an easy-to-follow payment plan - so you can finally eliminate your debt. Dec 2043 Pay-off Date. You can consolidate your debts by initiating a.

3 years 10 months. 799 to 2343 with autopay. Debt consolidation can be a useful way to combine multiple lines of high-interest credit card debt under a loan with one fixed monthly payment.

Interest on mortgage on the other hand is tax deductible. 4 years 5 months. The Debt Payoff Calculator does not use this method.

If youre not sure how much extra payment to add to payoff your mortgage by a given date try this mortgage payoff calculator here to figure the payoff in terms of time instead of interest saved. Trying to stay positive because after 20 days finally out of stork mode we have 1100 paid off of our debt but we still have 72k more to 8822 by Kari18212 2346. Undebtit has 9 different accelerated debt payoff methods to choose from including your own custom plan.

The monthly fee for the debt reduction program is 27 per month. Its popularity is due to low monthly payments and upfront costs. When homebuyers take out a mortgage its usually paid in monthly installments.

Rates as of 812022. Payment Date Payment Interest Paid Principal Paid Total Payment Remaining Balance. Debt consolidation involves taking out a single larger loan.

For these reasons more than 90 of student debt today is in the form of. This usually takes the form of a home equity loan personal loan or balance-transfer credit card. 27 years 2 months.

The Early Loan Payoff Calculator is another loan payoff calculator that will help you figure out how much extra to pay each month to pay down the loan by a desired years or months.

Debt Snowball Spreadsheet Debt Payoff Calculator Google Etsy Debt Snowball Spreadsheet Debt Snowball Debt Payoff

Debt Snowball Tracker Printable Debt Payment Worksheet Etsy Debt Snowball Debt Snowball Worksheet Credit Card Debt Payoff

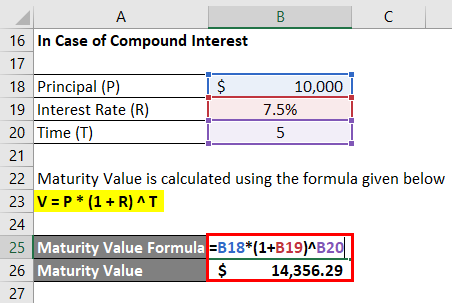

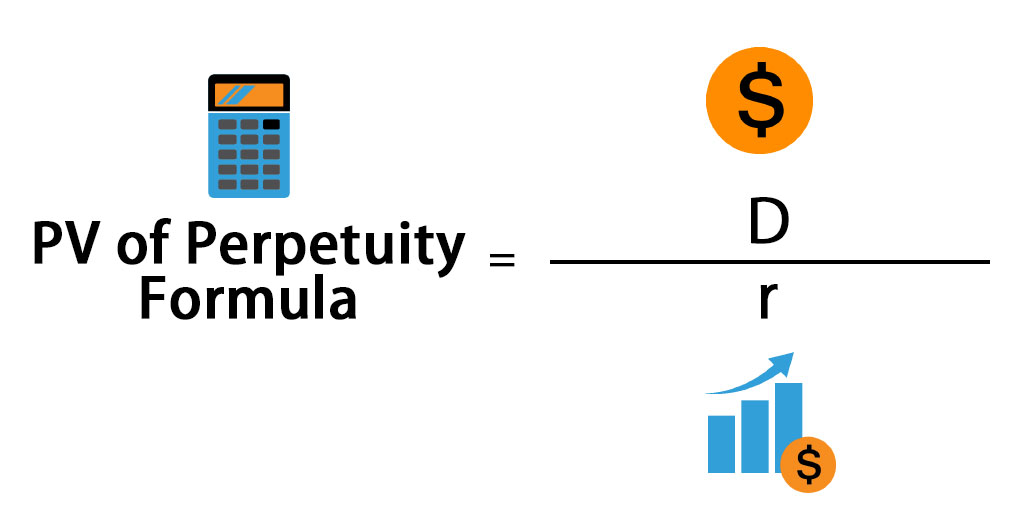

Maturity Value Formula Calculator Excel Template

Paying Off Debt Worksheets Credit Card Debt Payoff Paying Off Credit Cards Debt Payoff

Debt Payoff Calculator Spreadsheet Debt Snowball Excel Etsy Credit Card Debt Payoff Debt Payoff Credit Card Debt Tracker

Debt Snowball Calculator Debt Snowball Debt Payoff Worksheet

Debt Payoff Calculator Excel 15 Unconventional Knowledge About Debt Payoff Calculator Exce Loan Payoff Mortgage Payment Calculator Mortgage Payment

Coupon Rate Formula Calculator Excel Template

Debt Payoff Calculator Spreadsheet Debt Snowball Excel Etsy Credit Card Debt Payoff Saving Money Budget Money Saving Plan

Debt Payoff Calculator Spreadsheet Debt Snowball Excel Etsy Debt Payoff Money Makeover Credit Card Debt Tracker

Planner Inserts Debt Payoff Credit Card Interest How To Calculate Credit Card Interest Creditcard Creditcardinte Budgeting Money Budgeting Debt Payoff

Debt Snowball Spreadsheet Debt Snowball How To Plan

Maturity Value Formula Calculator Excel Template

Perpetuity Formula Calculator With Excel Template

Coupon Rate Formula Calculator Excel Template

Looks Like This Would Work Great If Following Dave Ramsey S Baby Steps Debt Payoff Spreads Credit Card Tracker Paying Off Credit Cards Debt Snowball Worksheet

Maturity Value Formula Calculator Excel Template